Fixed asset accounting

When must a self-employed person register a fixed asset?

If the purchase value of goods is below 1000 EUR:

No need to calculate depreciation - simply indicate the expense as low-value inventory.

If the value exceeds 1000 EUR:

Record the purchase and create a fixed asset card.

When must a company register a fixed asset?

SIA owners can register purchased inventory as a fixed asset from as little as 10 EUR if it is used in business.

A computer, phone, car, work software, or website - anything that helps to earn is a fixed asset.

Already more than 20,000 users in Latvia

Fixed asset accounting is easy!

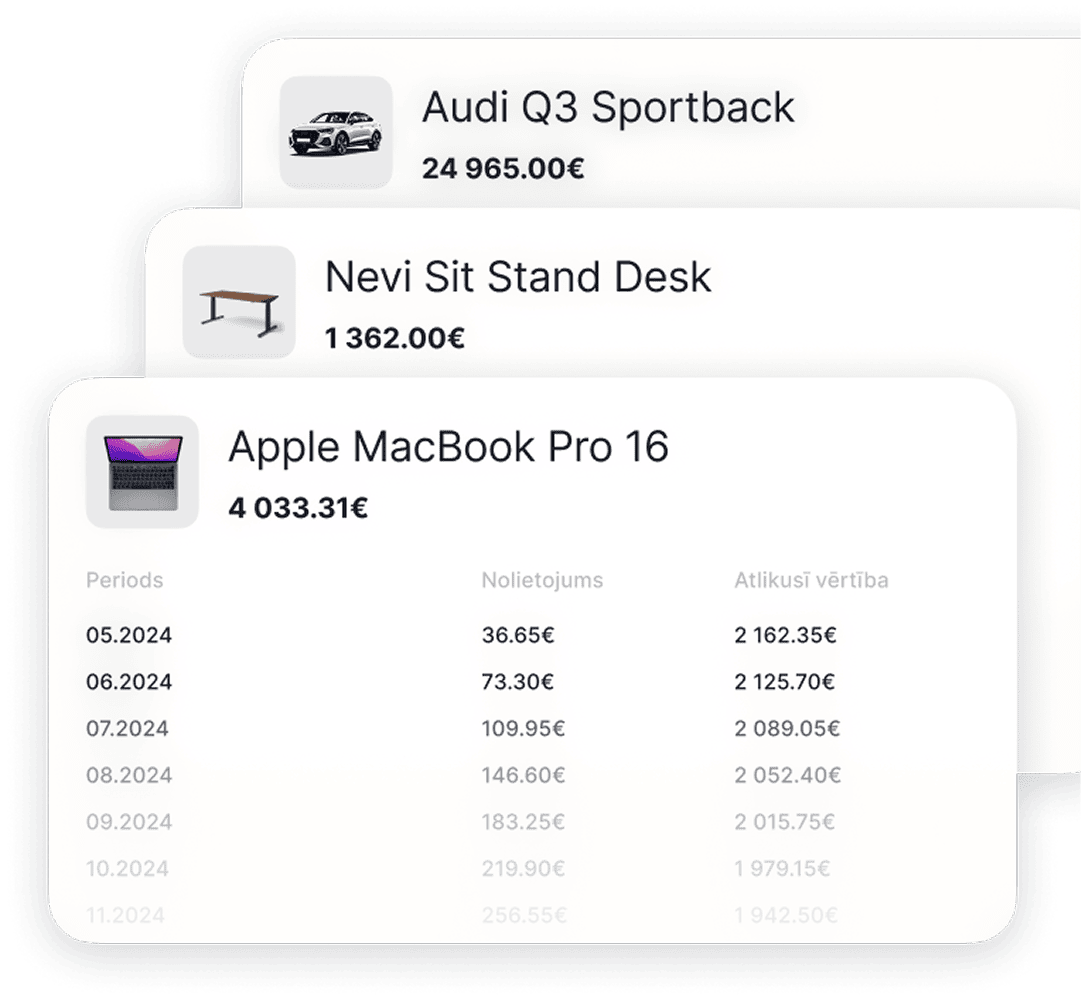

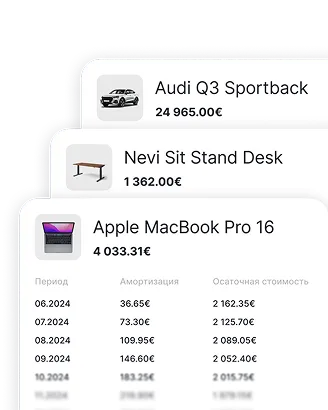

Choose the depreciation method

Linear (in monetary terms) or declining balance (in percentages)

Specify the period

Fixed asset depreciation every month or once a year

Enter the card

Specify the name, value, and purchase date of the fixed asset or investment

Save the card

Fixed asset depreciation will be calculated automatically

Fixed asset accounting is available in the PRO and PREMIUM plans

Linear or declining balance method?

- Linear - the same amount each year or month depending on the chosen method, helps to plan expenses

- Declining balance - larger amount at the beginning, smaller at the end. In some cases, it can be more advantageous

The user chooses which method to use. It can be changed no more than once every 10 years.

Depreciation frequency: monthly or yearly?

- If you choose monthly, expenses are recorded at the end of each month

- If you choose yearly, depreciation for the entire year is recorded in December

In the first month, depreciation is not recorded. Calculation starts in the following month or in January, depending on the period.

Fixed asset purchased on lease or on credit?

The fixed asset still has to be registered at its full value, but payments must be entered separately as expenses - both the principal amount and the interest.

How much does it cost

Functions

- 10 document scans

- Invite accountant

- Catalog of services and products

- Access to documents - 90 days

Invoices

- 10 invoices per month

- Language selection

- Invoice design selection

- Adding your own logo

- Electronic invoice

- Payment button directly in the invoice

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

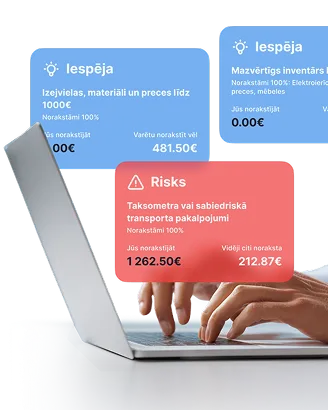

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Operations journal

- General ledger

- Corporate income tax declaration

- Annual report

- Balance sheet

- Profit and loss statement

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Income and expense ledger

- Self-employed person's social security contributions report

- Social contributions report for MUN taxpayers

- Value Added Tax (VAT) declaration for the taxation period

- Depreciation and value write-off calculation for fixed assets and intangible investments

- Employer’s report

- Information about employees

- Statement on amounts paid to a natural person

- Register of transactions starting from current month

- Adding transaction history starting from 2019

- Analytical recommendations for expense deduction

- Scanning of receipts and invoices

- Depreciation of fixed assets

- Linked bank account for automated upload of bank statements

- Invoicing

- Remote payment acceptance by card or bank transfer

- Payroll accounting

- Quick questions to an accounting and tax expert

Main system features

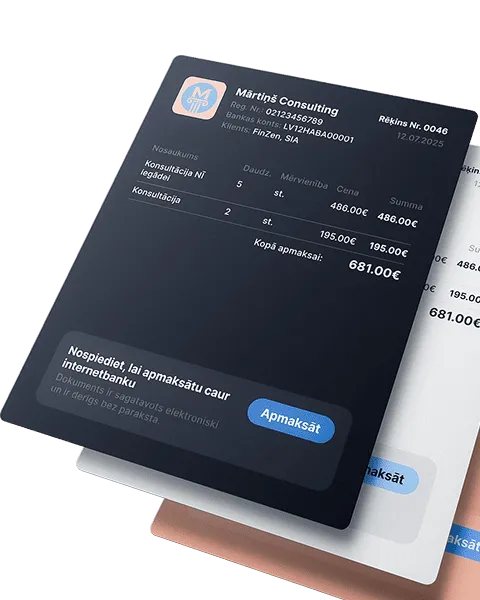

Issue invoices and get paid faster!

Automate the invoicing process, get paid faster, and focus on what truly drives your business forward

Receipt and invoice scanning

Automation that pays off! Save up to 80% of the time compared to manual data entry

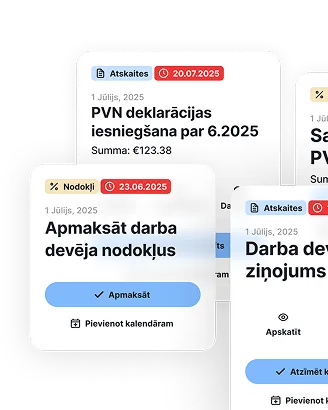

Reporting and tax calendar

All reports and tax declarations are generated automatically - from quarterly to annual. Enter your income and expenses, the system will calculate the taxes - just download and submit

Fixed asset accounting

Enter an asset once - depreciation is calculated automatically, and the data goes straight into the reports

Accept payments without a terminal

Instantly with a QR code or link - perfect for service providers without a cash register. Create an offer, the client scans and pays

Accurate salary calculation every month

Automatically calculates salaries, taxes, and vacation pay, while also preparing all mandatory documents

Bank integration and payment management

The fastest way to manage business transactions - accurately and clearly

Expense analytics and tips

Analyze your expenses and get smart tips on what can be deducted. Compare with others in your field and avoid missing out

What customers say

Frequently asked questions