Katram pieņemamā cenā ar nodokļu ieteikumiem

Automātiskas atskaites, vienkārša ieņēmumu un izdevumu ievade

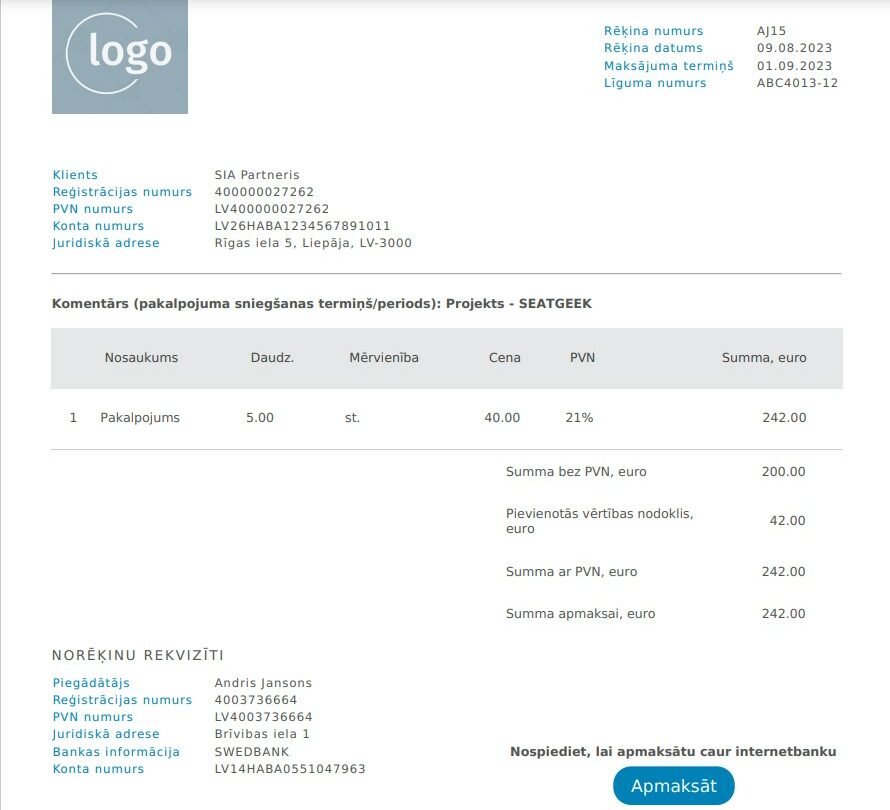

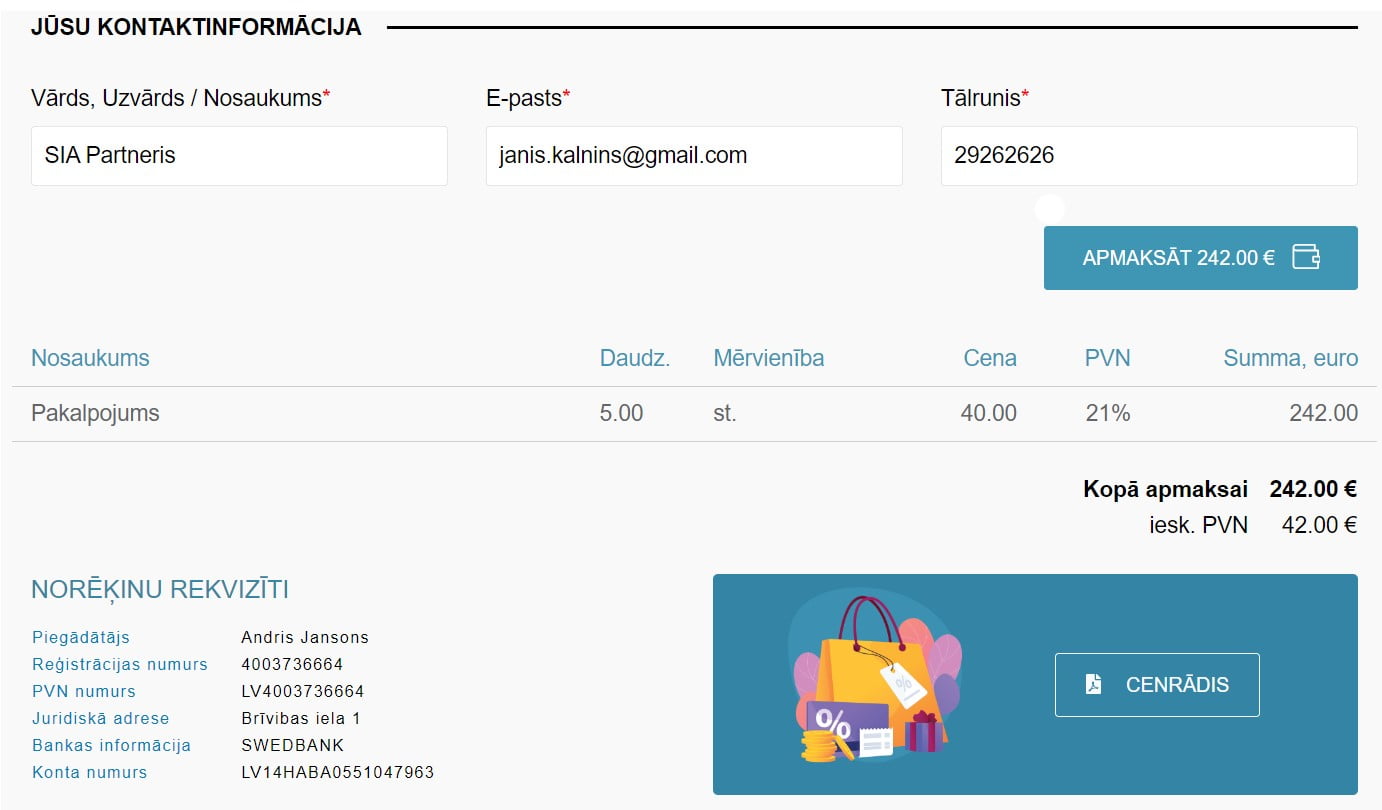

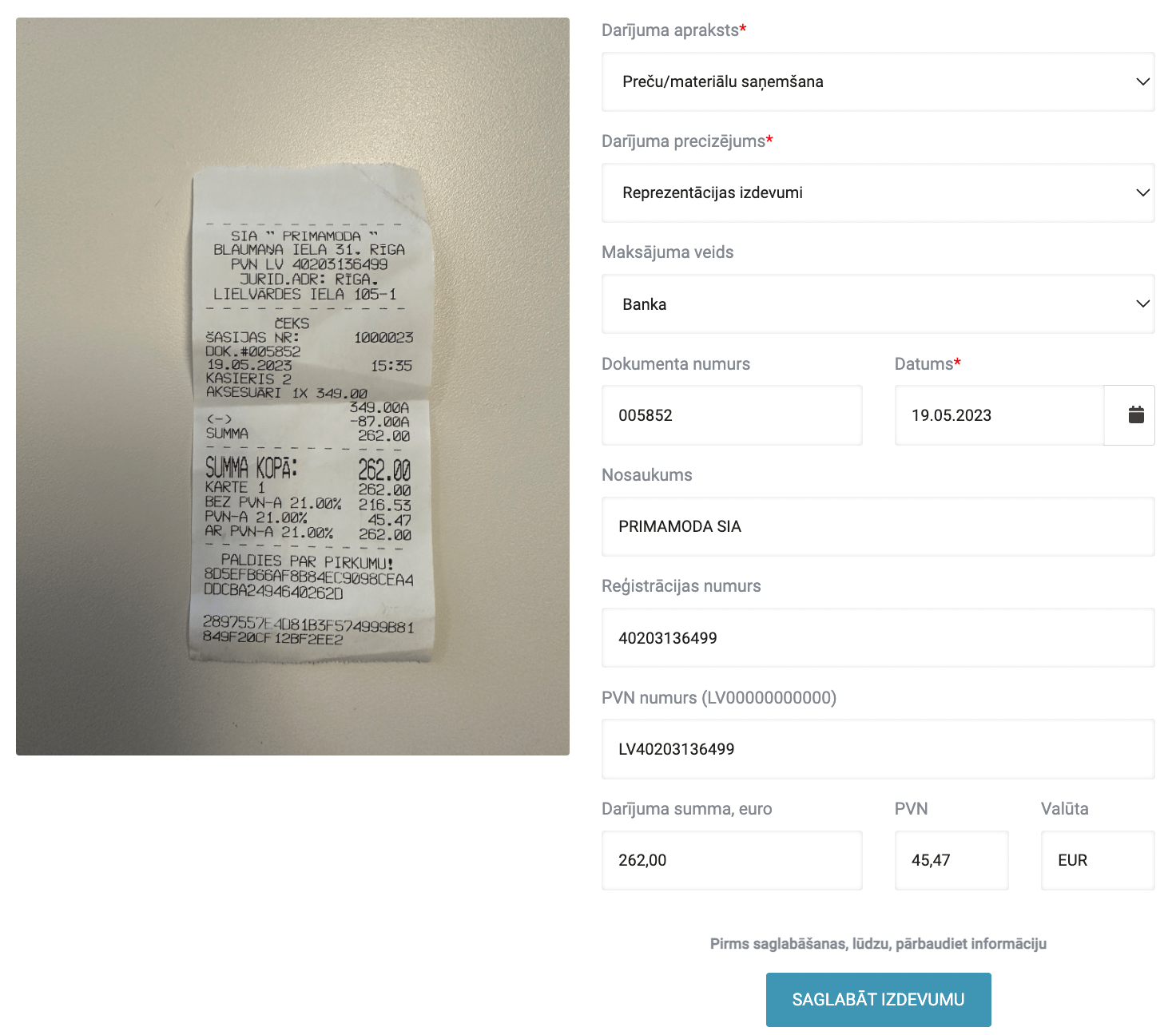

Izraksti rēķinus, nofotografē čekus, savieno ar banku

Izraksti rēķinus, nofotografē čekus, savieno ar banku

Automātiskas atskaites, vienkārša ieņēmumu un izdevumu ievade

Katram pieņemamā cenā ar nodokļu ieteikumiem

Paldies par Jūsu darbu un produktu! Jūs pat iedomāties nevarat, cik ļoti atvieglojat manu dzīvi un nervu sistēmu ar PATS.LV. Paldies, ka esat!

“Pats.lv ir labs “interface” un atskaites EDS, ko nevajag vadīt ar roku. Kā arī saimnieciskais žurnāls, kurš gatavojas pats. Man ļoti patīk, ka rēķinu var sūtīt uzreiz no sistēmas un banku var importēt no faila.”

“Grāmatvedība likās kosmoss un kur lai atrod labu grāmatvedi, kas man pratīs visu izskaidrot. Bet tad es pamanīju Instagram reklāmu par Pats.lv, un tas arī bija viens liels grūdiens uz savu saimnieciskās darbības sākšanu, sapratu, ka visu spēšu pati!”

“Periodā, kad man bija ļoti daudz darba, jutos nogurusi, ieraudzīju Pats.lv ierakstu un nolēmu, ka varbūt tomēr jāpamēģina. Izmēģināju 7 dienas, tad paņēmu lētāko komplektiņu – ja nu tomēr ilgtermiņā nenoderēs. Šobrīd varu teikt – man patīk, ka visu izrēķina manā vietā. Es arī redzu, ka šī programma manā vietā varētu izdarīt vairāk, tāpēc plānoju drīzumā pāriet uz Pro komplektu, lai ietaupītu vēl vairāk sava laika.”

“Lai gan skaitļi man ļoti patīk, no grāmatvedības neko nesaprotu. Tāpēc izvēlēties Pats.lv, kas šo problēmu palīdz risināt un tikai par vienas kafijas cenu mēnesī, bija pašsaprotama darbība, bez kuras neiztikt.”

“Pati grāmatvedība ir ļoti vienkārša, ja paņem vienreizēju konsultāciju pie grāmatveža par kvītīm utt., bet pašu uzskaiti veic pats.lv sistēmā. Jums tur viss ir tik vienkārši, kā arī atbalsta čats, ka patiesi atvieglo dzīvi. Par blogu atsevišķs PALDIES!”

“Pirmo reizi bija iespēja izmēģināt , kā darbojas portāls PATS.LV, ņemot vērā, ka iepriekš visas atskaites VID sniedza grāmatvedis, līdz ar to saprašanas par savas saimnieciskās darbības atskaišu izgatavošanu un finanšu pārvaldību īsti nebija. Sistēma ir viegli saprotama un darboties tajā un vadīt datus man grūtības nesagādāja. Patīk , ka sistēmā viss ir pārredzams un visa vajadzīga finanšu plūsmas informācija ir viegli izsekojama, tas ir, visi ienākumi un izdevumi, kā arī peļņa ir redzami savā profilā . Datu ievadīšana ir vienkārša , atskaišu sagatavošana – dažu “klikšķu” attālumā, kā arī rēķinu izrakstīšana ir pieejama uzreiz sistēmā. Viens no lielākajiem plusiem ir tas, ka sistēmai var piekļūt no jebkuras pasaules vietas, vajadzīgs ir tikai internets. Šāda veida sistēmu iepriekš nekur nebiju redzējusi, tas ir liels atvieglojums tādiem pašnodarbinātajiem, kuriem nav laika ilgi sēdēt pie datora. Šī sistēma noteikti atvieglo un saīsina iztērēto laiku, līdz ar to, varam iegūt vairāk laika savai saimnieciskajai darbībai un radošajiem projektiem. Noteikti iesaku vismaz pamēģināt!”

“Mani patīkami pārsteidza jaunumi PATS.LV, ka tagad es varu nofotografēt čeku un sistēma automātiski to ievadīs saimniecības darbības žurnālā. Tas ir ļoti ērti, jo man ir daudz čeku, ko es varu norakstīt.”

“PATS.LV sistēma ir devusi man krietni lielāku izpratni par to, kā pārvaldīt sava biznesa finanses un tām sekot līdzi, ņemot vērā valsts nodokļu sistēmu. Sistēma ir ļoti pārdomāta. Man personīgi visvairāk uzrunā tas, ka ir pieejamas atskaites un visi gada mēneši, kur ir atzīmētas nepieciešamās nodokļu apmaksas. Sistēma rada man skaidrību par to kas, kad un cik ir jāapmaksā nodokļos. Protams, pati rēķinu izrakstīšanas, ieņēmumu un izdevumu ievades sistēma ir ļoti skaidra un saprotama. Pats.lv sistēma man personīgi ir ļoti atvieglojusi darbu ikdienā, kā arī šī sistēma ļoti labi sadarbojas kopā ar manu grāmatvedi, arī viņai atvieglojot darbu. No sirds pateicos!”

Darījumu uzskaite sākot ar tekošo mēnesi

5 rēķinu izveide kopumā

5 čeku skenēšana mēnesī

5 rēķinu un piedāvājumu apmaksas pieprasījumi kopumā

Darījumu uzskaite sākot ar 2019.gadu

Rēķinu izveide neierobežotā daudzumā

Čeku skenēšana neierobežotā daudzumā

5 rēķinu un piedāvājumu apmaksas pieprasījumi kopumā

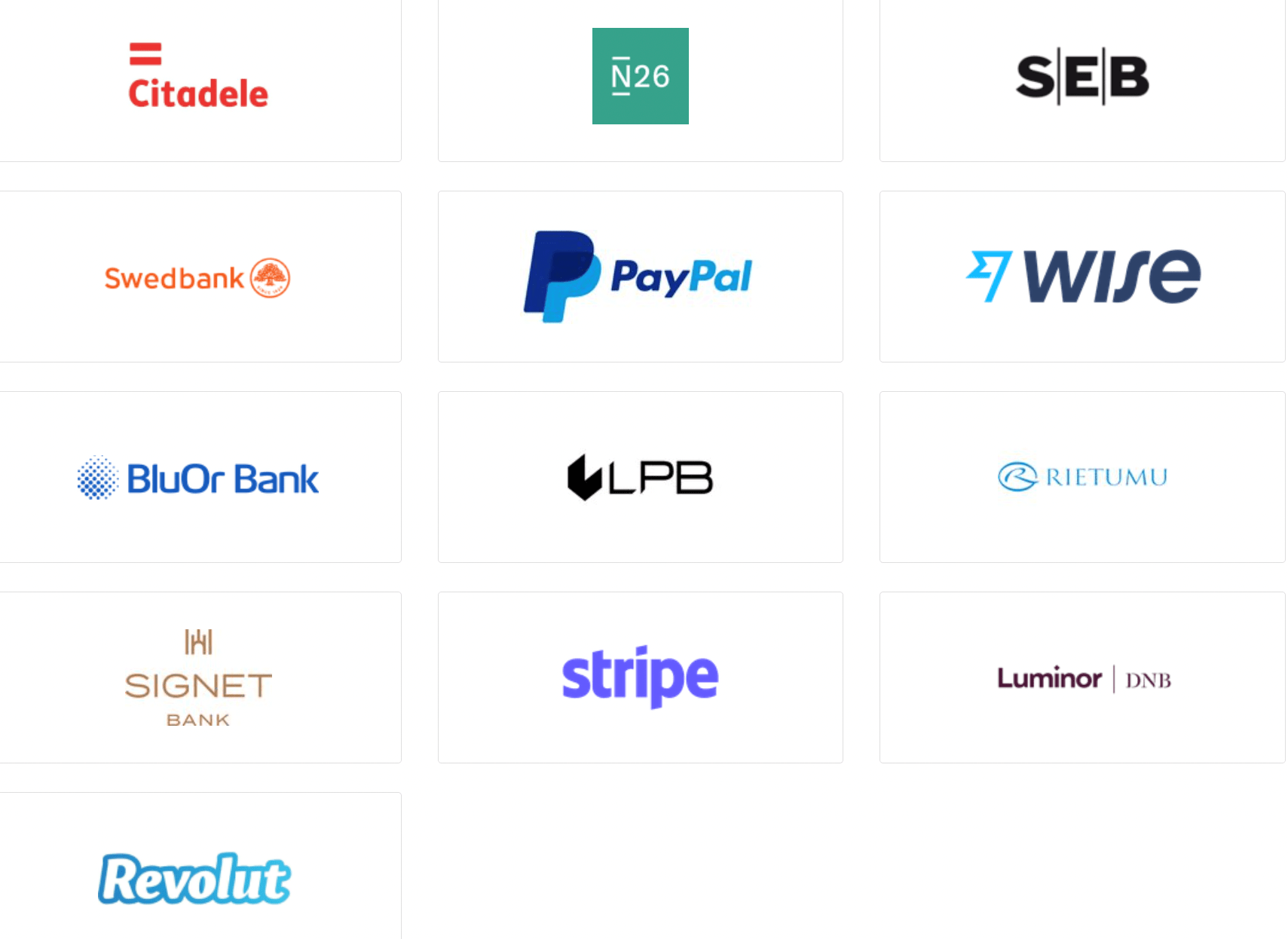

Bankas konta pieslēgšana izrakstu automātiskai saņemšanai

Pamatlīdzekļu nolietojums

Analītikas padomi izdevumu norakstīšanai

Darījumu uzskaite sākot ar 2019.gadu

Rēķinu izveide neierobežotā daudzumā

Čeku skenēšana neierobežotā daudzumā

40 rēķinu un piedāvājumu apmaksas pieprasījumi mēnesī

Bankas konta pieslēgšana izrakstu automātiskai saņemšanai

Pamatlīdzekļu nolietojums

Analītikas padomi izdevumu norakstīšanai

Jautājumi ekspertam

Darījumu uzskaite sākot ar tekošo mēnesi

5 rēķinu izveide kopumā

5 čeku skenēšana mēnesī

5 rēķinu un piedāvājumu apmaksas pieprasījumi kopumā

Darījumu uzskaite sākot ar 2019.gadu

Rēķinu izveide neierobežotā daudzumā

Čeku skenēšana neierobežotā daudzumā

5 rēķinu un piedāvājumu apmaksas pieprasījumi kopumā

Bankas konta pieslēgšana izrakstu automātiskai saņemšanai

Pamatlīdzekļu nolietojums

Analītikas padomi izdevumu norakstīšanai

Darījumu uzskaite sākot ar 2019.gadu

Rēķinu izveide neierobežotā daudzumā

Čeku skenēšana neierobežotā daudzumā

40 rēķinu un piedāvājumu apmaksas pieprasījumi mēnesī

Bankas konta pieslēgšana izrakstu automātiskai saņemšanai

Pamatlīdzekļu nolietojums

Analītikas padomi izdevumu norakstīšanai

Jautājumi ekspertam

Darījumu uzskaite sākot ar 2019.gadu

Rēķinu izveide neierobežotā daudzumā

Čeku skenēšana neierobežotā daudzumā

5 rēķinu un piedāvājumu apmaksas pieprasījumi kopumā

Bankas konta pieslēgšana izrakstu automātiskai saņemšanai

Pamatlīdzekļu nolietojums

Analītikas padomi izdevumu norakstīšanai

Darījumu uzskaite sākot ar tekošo mēnesi

5 rēķinu izveide kopumā

5 čeku skenēšana mēnesī

5 rēķinu un piedāvājumu apmaksas pieprasījumi kopumā

Darījumu uzskaite sākot ar 2019.gadu

Rēķinu izveide neierobežotā daudzumā

Čeku skenēšana neierobežotā daudzumā

40 rēķinu un piedāvājumu apmaksas pieprasījumi mēnesī

Bankas konta pieslēgšana izrakstu automātiskai saņemšanai

Pamatlīdzekļu nolietojums

Analītikas padomi izdevumu norakstīšanai

Jautājumi ekspertam

Darījumu uzskaite sākot ar 2019.gadu

Rēķinu izveide neierobežotā daudzumā

Čeku skenēšana neierobežotā daudzumā

5 rēķinu un piedāvājumu apmaksas pieprasījumi kopumā

Bankas konta pieslēgšana izrakstu automātiskai saņemšanai

Pamatlīdzekļu nolietojums

Analītikas padomi izdevumu norakstīšanai

Darījumu uzskaite sākot ar tekošo mēnesi

5 rēķinu izveide kopumā

5 čeku skenēšana mēnesī

5 rēķinu un piedāvājumu apmaksas pieprasījumi kopumā

Darījumu uzskaite sākot ar 2019.gadu

Rēķinu izveide neierobežotā daudzumā

Čeku skenēšana neierobežotā daudzumā

40 rēķinu un piedāvājumu apmaksas pieprasījumi mēnesī

Bankas konta pieslēgšana izrakstu automātiskai saņemšanai

Pamatlīdzekļu nolietojums

Analītikas padomi izdevumu norakstīšanai

Jautājumi ekspertam

Balstoties uz lietotāja ievadīto informāciju, sistēma automātiski aprēķina valsts obligātās sociālās apdrošināšanas iemaksas (VSAOI), PVN, un sagatavo attiecīgas nodokļu atskaites – pašnodarbinātā vai induviduālā komersanta ceturkšņa ziņojumus, PVN deklarācijas, MUN deklarācijas, kā arī saimnieciskās darbības ieņēmumu un izdevumu uzskaites žurnālu.

Ar svarīgāko informāciju par nodokļiem varat iepazīties mūsu mājas lapā (gan video, gan blogu aprakstos) un sociālajos tīklos. Tomēr ja nepieciešama Individuālā apmācība un nodokļu ekspertu palīdzība to ir iespējams saņemt iegādājoties Premium tarifu.

Ja radušies jautājumi vai neskaidrības ar sistēmas PATS.LV lietošanu, tad varat rakstīt uz [email protected] vai Facebook live chat. Lietotājs atbildi saņem tiklīdz jautājums ir izskatīts, parasti ne vēlāk kā vienas darba dienas laikā.

Jaunajiem lietotājiem ģenerējas individuālais PROMO kods reģistrācijas brīdī un to var izmantot līdz dienas beigām, lai iegādātos abonementu ar 25% atlaidi sadaļā – Abonements.

Saskaņā ar Lietošanas noteikumu redakciju, ja lietotājs nav veicis apmaksu par sistēmas lietošanu, tad lietotājam pieejamo sistēmas funkciju klāsts tiks ierobežots, un lietotājs varēs tikai pieslēgties savam profilam, veikt apmaksu un piekļūt tai lietotāja informācijai, kas bija ievadīta pirms sistēmas ierobežojumu piemērošanas (ievadītās informācijas skatīšana, rediģēšana un eksportēšana).

Šāds funkciju kopums lietotājam būs pieejams 90 kalendārās dienas pēc bezmaksas perioda vai pēdējā apmaksātā perioda beigām. Šajā laika periodā lietotājam ir jāveic apmaksa par pakalpojumu.

Gadījumā, ja lietotājs nav veicis apmaksu iepriekšminētajā periodā, tad pēc šī perioda beigām profils būs pieejams lietotājam vēl 90 kalendārās dienas tikai abonementa iegādei un apmaksai. Ja lietotājs nebūs veicis apmaksu šo 90 kalendāro dienu laikā, tad pēc šī termiņa beigām lietotāja profils tiks bloķēts un darījumattiecības ar lietotāju tiks izbeigtas, savukārt vēl pēc 10 kalendārajām dienām lietotāja profils tiks dzēsts.

Pēc profila dzēšanas visi dati tiek dzēsti.

Reģistrēties kā juridiskai persona nav iespējas, bet kā grāmatvedis, kas apkalpo pašnodarbinātās personas un individuālos komersantus, var sekojot saitei:

Sistēma PATS.LV ir piemērota vairākām saimnieciskās darbības reģistrācijas formām:

– pašnodarbinātām personām kas reģistrējās VID

– individuāliem komersantiem, kas reģistrējās UR

– saimnieciskās darbības veicējiem (gan pašnodarbinātiem, gan IK) ar MUN statusu.

Jā, sistēmu var savienot ar savu bankas kontu.

Diemžēl šobrīd šāda savienojuma nav, bet ir zināms, ka VID šobrīd aktīvi strādā pie tā, lai radītu šādu iespēju. Pašlaik Jums ir jāveic atskaites lejupielāde no sistēmas manuāli un tās ielāde EDS sistēmā.

Dati saglabāsies arī pēc izmēģinājuma perioda beigām. Tikai lūdzam ņemt vērā, ka pēc izmēģinājuma perioda labot šos vēsturiskos darījumus varēsiet tikai pēc apmaksas veikšanas.

Jā, ir